In a period of instability, as the one that we are witnessing, it has been crucial for Boards to go back to the basics of both financial and good Corporate Governance. And it will also be so in the future if we think about the consequences of Brexit and Covid-19, and the newfound uncertainty of our time.

Why, however, is it still commonplace that the Audit Committee’s activities are purely technical and that its members do not have such a “fun” profession? With the following, I will try to answer this hard question.

It is fitting to focus on the Audit Committee. The Committee is necessary for companies listed in the italian, european and american markets and also for regulated companies. While in Italy it can match with the Board of the Statutory Auditor (traditional Corporate Governance model), with the Supervisory Board (two-tier) or with the Management Control Committee (one-tier), in the G20 countries – where the Board of the Statutory Auditor is not applied – the Audit Committee is natively a Board committee, along with the Risks, Nomination and Remuneration committees, if established.

The responsibilities of the Audit Committee are, in general, ascribed to the financial information, to the process and to the internal control system for its creation. Since the external and internal auditors play a vital role for the activities carried on by the Audit Committee, the latter is in charge of their supervision. The Audit Committee can also take the responsibility of the supervision of the Risk management – if not attributed to a specific committee or directly to the Board – and of the Compliance.

Zooming into the processes of Corporate Governance, it is easier than not to be aware that the Audit Committee is the cornerstone for the protection of all stakeholders. And it is for this reason that the Audit Committee members must be independent from both the management and the company and, especially, to be able to think autonomously. As I reported in my recent work, in “some countries … the concept of “independence of mind” … goes beyond determining whether candidates have a conflict of interest and is related to the ability to challenge directors and senior management and avoid (or at least mitigate) the risk of groupthink”.

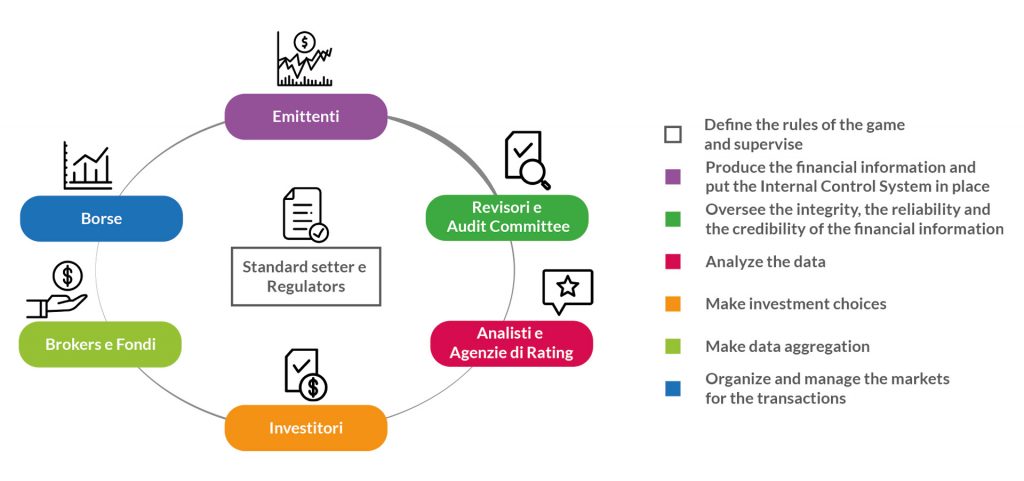

With a wider vision, considering the financial market ecosystem, the subjects that it is made up of and the relations with the issuer, the Audit Committee represents, in substance, the starting point of the chain of relationships among the various participants.

The Audit Committee cannot represent the weakest ring of such a chain because it cannot be far from being the advocate of the integrity, of the reliability and of the credibility of the financial information (data and disclosure) towards all the stakeholders. And, in doing so, it becomes one of the main presidium for safeguarding the most valuable asset of the company, its reputation.

Nevertheless, the involvement of the Audit Committee is not limited to the financial information. Indeed, a robust increase of both income and profit that generate positive cash flows, in addition to being necessary for a wealthy company in the short term, are becoming more crucial to enable companies to realize such a long-term sustainable success of the modern Code of Corporate Governance. As a consequence, companies and Boards are more than ever focused on KPIs for the monitoring of both the performance and the wealth on a long-term basis, with ever increasing attention to the those related to the ESG (Environmental, Social and Governance). All of this, while waiting for the Corporate Sustainability Reporting of the proposal for a European Directive published on April 21, 2021, to land on the tables of the Audit Committees.

To enable the Audit Committee to perform its function and create value it must necessarily make a reference to the strategy of the company, to its underpinning values and to the environment in which it moves. And this cannot not be reflected on the strategy for the reporting and the disclosure of the financial information. And at this point there is a choice to be made: to disclose the financial information according to the minimal requirements as requested by the Regulators or to disclose one that fosters dialogue among the stakeholders and financial market ecosystem’s participants?

Are we convinced that the Audit Committee members do not carry on such a “fun” profession?